Daily life

Tourist tax

In Val d'Isère, all non-domiciled guests staying in commercial accommodation are required to pay the tourist tax (rates per person per night). The tax is collected by the landlord from the guests.

Price list :

The table below shows the applicable rates, including the additional departmental tax of 10%.

The proportional rate is capped at €5.28 from 1 January 2025 (€5.06 until 31 December 2024)

Proportional tariff calculation :

Proportional rate = (price per night x 5%) + 10%.

A calculator allows you to simulate the amount to be received on https://valdisere.taxesejour.fr/

The following are exempt from paying the tourist tax:

- Persons under 18 years of age;

- Holders of seasonal employment contracts ;

- People benefiting from emergency accommodation.

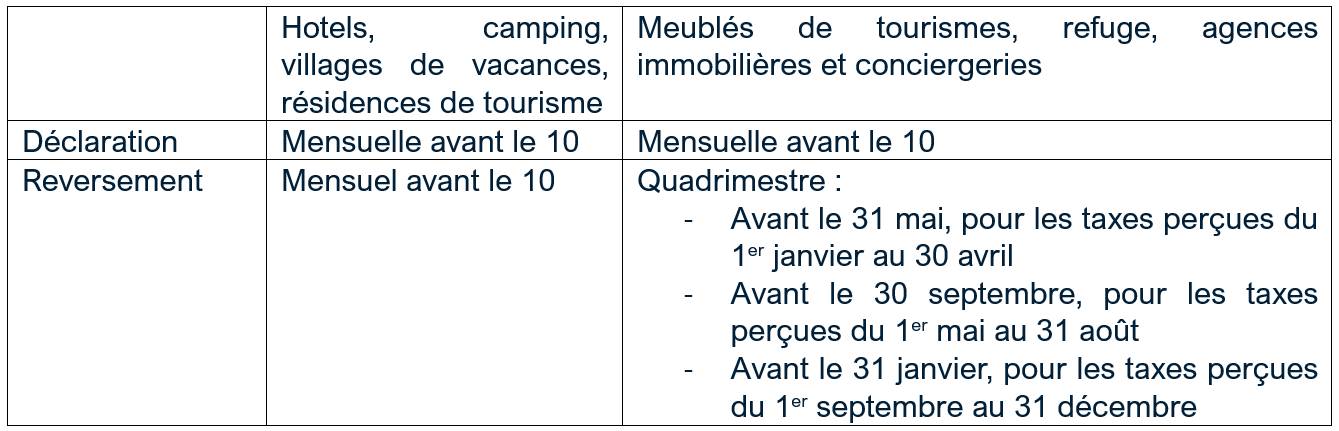

When to declare and pay the taxe de séjour to the local authority?

How do I declare the taxe de séjour to the local authority?

- Go to : https://valdisere.taxesejour.fr/

- Fill in the online holiday register or attach your own legally compliant register to your global declaration.

Reminder: declarations are mandatory. If no rentals have been made, a zero or closed period declaration must be validated.

How do you pay the taxe de séjour back to the local authority?

- Directly online from your hosting account by credit card or direct debit

- By bank transfer to the "taxe de séjour" account

- By cheque (in the form of a global cheque) payable to "Régie taxe de séjour". Enclose the signed summary statement with your payment and return it to :

Tourist tax - Town hall

Immeuble le Thovex - BP 295

73155 Val d'Isère Cedex

Email : valdisere@taxesejour.fr